Leasing Solutions for Challenging Financing needs - Gap Finance

Learn more about Leonardo Lease

DiscoverAbout Leonardo Lease

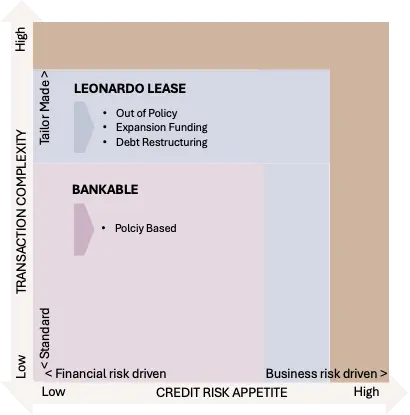

Leonardo Lease is a certified leasing company, providing solutions to fund equipment in situations where traditional funders are hesitating

Belgian certified leasing company

Located near Brussels, we are a certified provider of leasing solutions, specializing primarily in sale-and-leaseback arrangements

Business-oriented risk appetite

We assess funding requests through an industrial lens, enabling us to evaluate projects based on their underlying business

Tailored Made Solution

Due to our experienced team, we are able to go further than traditional funding and offer solutions which fit the specific needs of the companies

Gap Finance

With our support, companies can confidently pursue growth, knowing that their financial needs will be met with tailored solutions beyond the limitations of conventional funding

We provide tailored financing solutions where traditional funders step back

Out of policy transactions

Transactions involving bank-approved companies with specific asset-based funding needs that do not fit within bank lending policies due to the nature of the asset or contract specifics (e.g., tenor)

Expansion funding

Some companies may require significant CAPEX programs at certain times, impacting financial ratios to make bank lending more challenging. Leonardo Lease can provide supplementary asset-based funding

Debt restructuring

In the context of a debt restructuring transaction within a viable return-to-normal scenario, Leonardo Lease can offer additional asset-based funding to create additional liquidity

Learn more about us

Not sure how we can help? Take a look at some of our use cases

Use-cases

Asset based financial leasing

CAPEX investment

Out of Policy Transaction

Discover our use casesOur process

1

Intake meeting

After contacting us, we set up an intake meeting with our experts, giving feedback & indicative terms & solutions

2

In depth analysis

Based on an indicative term sheet, we evaluate the Business plan, financials, assets and current management

3

Binding Term Sheet

After thorough evaluation by our investment committee we provide a binding term sheet

4

Documentation

The agreement is formalized based on appropriate documentation

5

Pay Out

After signing & closing the deal, payout is processed promptly

Need for financial leasing solutions?

Contact us for an intake meeting

Meet our team

Founded and owned by Bimvest, Edito along with other private investors focused on assisting companies in their growth.

Patrick Beselaere

Chief Executive Officer

Patrick is a seasoned executive with extensive international finance experience, known for his leadership in corporate and asset-based finance. He has held senior roles in transaction structuring, operations, risk management, and general management, as well as board positions at ING Lease & Commercial Finance, Leaseeurope, and Febelfin. He currently leads projects leveraging his expertise in asset-based finance and private debt

Bruno De Mulder

Chairman

Bruno is a commercial engineer and graduated from the Catholic University of Leuven. During his work at the former National Guard, he saw an opportunity in the inefficiencies surrounding procurement activities and established EBP in 1997. In the spring of 2015, he successfully sold the company to a French group. After the sale he founded the holding company 'Bimvest'. This investment vehicle is active in various sectors www.bimvest.be

Herman De Boeck

Chief Financial Officer

Herman is a senior professional with specific expertise in creating and guiding teams of enthusiastic “engaged” people in medium to large enterprises: “With more than 20 years of experience with most aspects of the overall management function, he focuses on the identification and implementation of structural improvements

Arne Gutermann

Head of Legal

Arne is a senior professional with extensive expertise in law and finance. After a 30-year career as a lawyer and partner in a large international corporate & business law firm based in Brussels, focusing on commercial contracts, M&A transactions and corporate law, he now runs since a number of years an independent investment funds management business

Top questions answered

In this section, you can address common questions efficiently.

Leonardo Lease is interested in assets that possess long-term economic value, including but not limited to transport and logistics equipment, handling and construction machinery, manufacturing equipment, aircrafts, and vessels

Leonardo Lease does not have predetermined sector preferences; however, we require a thorough understanding of each client's business activities. Please note that we do not specialise in start-ups, high-tech or biotech industries, nor do we typically engage with the hospitality sector (horeca)

Yes, we do. The equipment does not need to be brand new; however, it must possess a sufficiently long remaining economic lifespan relative to the duration of the leasing agreement

We offer customised solutions, with ticket sizes ranging from a minimum of EUR 750,000 up to EUR 5,000,000

Leonardo Lease provides both financial and operational leasing solutions, in accordance with Belgian GAAP accounting standards

The residual value is established through a dedicated valuation conducted as part of the funding request assessment process

Yes. Leonardo Lease positions itself as a partner providing supplementary funding within a broader financial framework

Leonardo Lease was founded by two family offices, Bimvest and Edito. Both organisations bring extensive industry expertise and maintain a broad network of investors. The firm is managed by Patrick Beselaere, who possesses a distinguished record in asset-based finance across Europe